The Rise of Bitcoin and Cryptocurrencies

The Genesis of Bitcoin

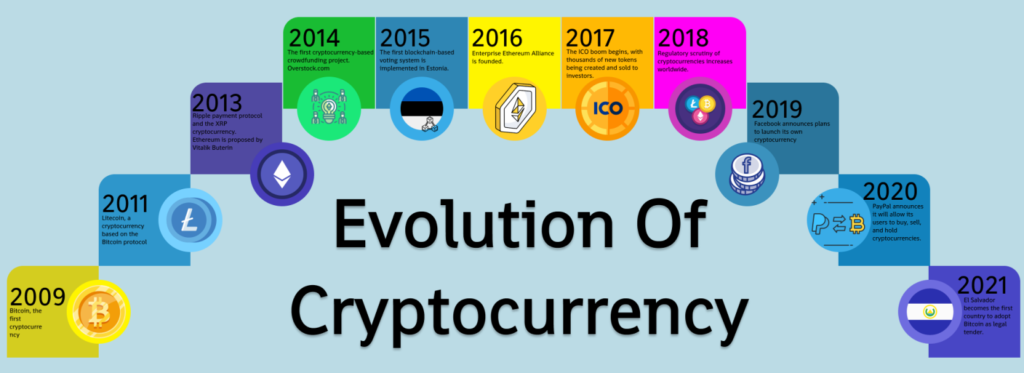

Bitcoin, the pioneering cryptocurrency, was introduced in 2009 by an anonymous entity known as Satoshi Nakamoto. This revolutionary digital currency emerged as a response to the 2008 financial crisis, aiming to create a decentralized and transparent financial system. Bitcoin’s launch marked the beginning of a new era in digital finance, setting the stage for the development of numerous other cryptocurrencies.

The Proliferation of Cryptocurrencies

image by https://isieindia.com/

Following Bitcoin’s success, a plethora of alternative cryptocurrencies, or altcoins, have been developed. These include Ethereum, Ripple (XRP), Litecoin, and more, each offering unique features and improvements over Bitcoin. Ethereum, for instance, introduced smart contracts, enabling the execution of decentralized applications (dApps) on its blockchain. The growth of these cryptocurrencies has expanded the blockchain ecosystem, fostering innovation and competition in the digital currency space.

How Blockchain Underpins Cryptocurrencies

Image source: The Motley Fool

The Fundamentals of Blockchain Technology

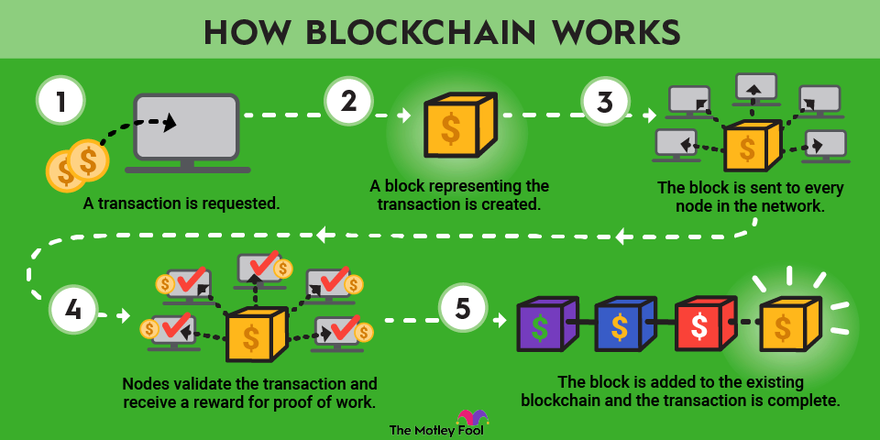

Blockchain is a distributed ledger technology that records transactions across a network of computers. It ensures transparency, security, and immutability by creating a decentralized database where each transaction is verified and recorded by network participants. The key components of blockchain include blocks, nodes, and consensus mechanisms.

- Blocks: Each block contains a list of transactions, a timestamp, and a reference to the previous block, forming a chain.

- Nodes: Nodes are individual computers that participate in the blockchain network, validating and relaying transactions.

- Consensus Mechanisms: These protocols, such as Proof of Work (PoW) and Proof of Stake (PoS), ensure that all nodes agree on the validity of transactions, maintaining the integrity of the blockchain.

Security and Decentralization

image source: shutterstock

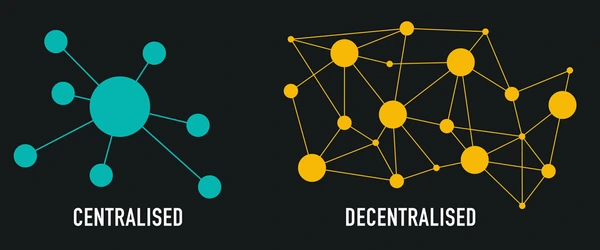

Blockchain’s decentralized nature eliminates the need for a central authority, reducing the risk of fraud and manipulation. Cryptographic techniques, such as hashing and digital signatures, further enhance security by ensuring data integrity and authenticity. This decentralized and secure structure is the backbone of cryptocurrencies, enabling trustless and transparent transactions.

The Impact of Cryptocurrencies on the Global Economy

Financial Inclusion and Empowerment

image source: fastercapital

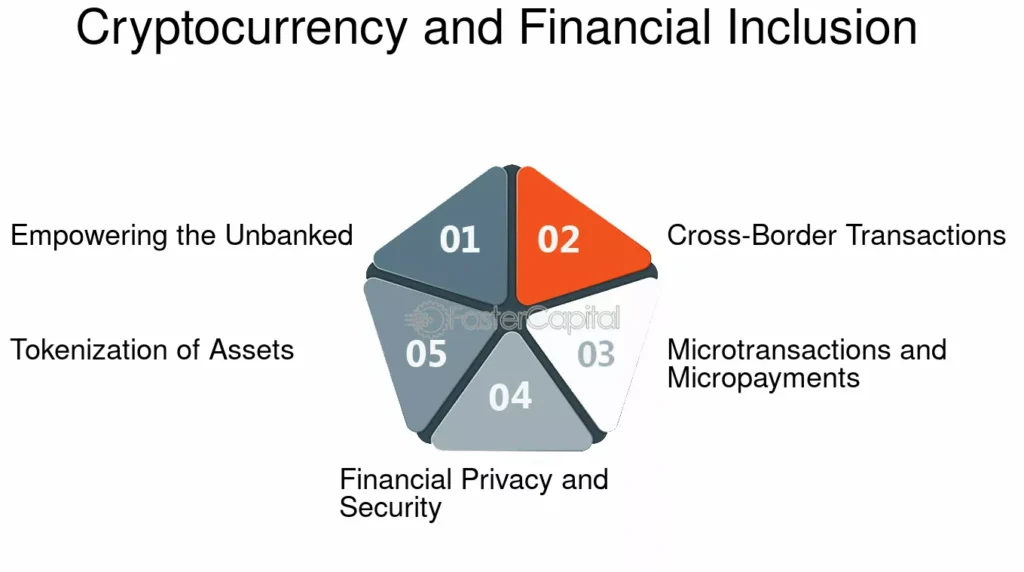

Cryptocurrencies have the potential to revolutionize the global financial system by providing access to financial services for the unbanked and underbanked populations. In regions with limited banking infrastructure, cryptocurrencies offer a means of transferring and storing value without the need for traditional financial institutions. This financial inclusion empowers individuals, promoting economic growth and reducing poverty.

Disruption of Traditional Financial Systems

The rise of cryptocurrencies poses a challenge to traditional banking and financial systems. Cryptocurrencies enable peer-to-peer transactions, bypassing intermediaries such as banks and payment processors. This disintermediation can lead to lower transaction fees, faster cross-border payments, and increased financial autonomy for individuals and businesses. However, it also raises concerns about regulatory oversight, money laundering, and financial stability.

Investment Opportunities and Market Volatility

Cryptocurrencies have emerged as a new asset class, attracting investors seeking high returns. The volatility of cryptocurrencies, driven by market speculation and regulatory developments, presents both opportunities and risks for investors. While early adopters have reaped significant gains, the market’s unpredictable nature underscores the need for careful consideration and risk management.

Technological Innovation and Blockchain Applications

Beyond their financial implications, cryptocurrencies have spurred technological innovation. Blockchain technology, the underlying infrastructure of cryptocurrencies, has potential applications across various industries, including supply chain management, healthcare, and voting systems. These applications promise to enhance transparency, efficiency, and security in numerous sectors, driving economic and societal advancements.

Conclusion

The rise of Bitcoin and other cryptocurrencies marks a significant milestone in the evolution of digital finance. Underpinned by blockchain technology, cryptocurrencies offer a decentralized, secure, and transparent alternative to traditional financial systems. Their impact on the global economy is multifaceted, encompassing financial inclusion, disruption of traditional systems, investment opportunities, and technological innovation. As the cryptocurrency ecosystem continues to evolve, it is poised to shape the future of finance and technology in profound ways.

By understanding the intricacies of blockchain and cryptocurrencies, stakeholders can navigate this rapidly changing landscape, leveraging its benefits while addressing its challenges. The ongoing dialogue between innovators, regulators, and users will be crucial in realizing the full potential of this transformative technology.

This is helpful